Thinking About Retirement

As time passes, it’s easy to forget about the pension amount deducted from your wages or your bank account.

As thoughts of retirement draw closer, though, you might be considering whether you are paying enough into your pension to provide an income when you need it.

What is a good income for retirement? Will you be able to pay your bills, have a holiday, or eat out? And how much extra do you need to save in your pension each month to achieve a minimum retirement income?

Other questions might include your state pension, such as when can you start to claim your money and how much will you get each week?

By answering these questions, and with the help of a pension adviser, you can plan your ideal retirement.

Retirement Income Advice from Prosperity Wealth

Based in the West Midlands, Prosperity Wealth is FCA regulated and has provided pension advice on transfer values for many years, with thousands of happy clients and £1bn in funds under management.

At Prosperity Wealth, we believe that the value of an adviser is in the detail and the openness we provide, which is crucial when planning your retirement.

We’ve tried to answer as many of your questions on retirement as possible so that you can get the facts.

You might be surprised to find out that you can achieve a comfortable standard of retirement even if you only start saving in your 40s. As a couple, you’ll need to contribute around £384 per month.

How Much Do I Need In My Pension To Retire Comfortably?

A good retirement income is different for everyone, as it depends on your ideal lifestyle upon finishing work, your financial commitments each month, and the cost of living.

If you manage to pay off your mortgage, your retirement income may not need to be high, but you might want to live a similar or enhanced lifestyle when you have more time — with meals out, hobbies, and holidays.

What is certain is that it can come as a surprise that you may need to increase your pension contributions considerably; you might need to change how your money is invested to reach your ideal retirement income.

Average Retirement Income In The UK

According to Government research, the average weekly income for a pensioner family (up to two in a household) in 2019 in the UK was £548 per week after taxes and housing costs.

For 60% of pensioners, this also includes income from a workplace or personal pension.

On average, the state pension pays pensioners £189 per week, but this varies based on how much National Insurance a person has paid before claiming a state pension.

So, this works out at £28,496 for a pensioner family per year.

You can check your state pension forecast and what age you can claim your pension on the UK Government’s website.

What Is The Minimum Retirement Income?

According to the PLSA, 77% of savers can’t give a figure on what they will require in retirement, so you’re not on your own if you don’t know.

It’s for this reason that the PLSA has provided the following information based on their research:

Retirement Income Statistics

According to Which?, who surveyed over 2000 pensioners, they spent £2110 per month in 2020, which is around 5% lower due to the COVID pandemic. So, £25,320 per year seems to be a more realistic figure give or take 5%.

Taking a closer look at this £25,320 figure, what exactly are pensioners spending money on?

A combined cost of £17,200 was essential expenditure, with the rest spent on luxuries such as European holidays, hobbies, and eating out, which is quite reasonable for the average couple.

With that in mind, what does luxury look like in reality? According to Which?, pensioners with a taste for the finer things in life are spending around £40,000 per year, which concurs with PLSA research.

So, if you’d like a new car every five years, to travel on long-haul flights to holiday destinations, and eat out more frequently, then you’ll need to plan for a more luxurious retirement.

Which? also reported that, not surprisingly, holidays and eating out are important to pensioner couples, who spend £4,540 a year on both those pastimes.

How Much Will I Need To Save For My Retirement Income?

It helps to understand how much you need to save in your pension every month to try and achieve your retirement goals, whether that’s the minimum, moderate, or comfortable level.

As you would expect, the earlier you start investing in a pension the better, but the likelihood is that you start to think about your retirement in your 40s.

Comfortable retirement lifestyle pension amount

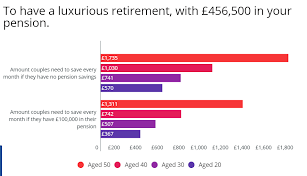

At 40, you’ll need to be contributing £384 per month as a couple to aim for a comfortable retirement at state pension age and this triples to £1,034 if you’d like those long-haul flights.

A comfortable retirement will mean having £169,175 in your pension pot but don’t forget that these figures are based on growth of 3%, you having your state pension in addition, and you will need to consider inflation rises.

Luxury retirement lifestyle pension amount

A luxury lifestyle will mean having almost half a million in your pension pot (£456,500), which will mean contributing £1,030 as a couple every month.

It demonstrates that if you start saving for your pension in your 20s, you can pay a reasonable amount (with employer contributions) and achieve an excellent retirement lifestyle.

Confused with all of the retirement pension income figures?

It’s easy to get confused by all of the figures and not know where to start. A pension adviser will start by taking a look at:

- What pension policies do you currently have and what is the value to you on retirement?

- How are these pensions performing in terms of your investments? How much are you paying into these pensions?

- What is the value of your state (Government) pension based on the years of National Insurance you have paid, and when will you be able to access it?

- How comfortable are you with risk (in terms of investment) and how much can you afford to pay?

- What type of retirement are you happy with, for example, minimum, moderate, or comfortable.

To Conclude

The pension adviser will then be able to forecast how much you’ll currently be provided with every month when you retire. A plan can then be discussed to help you to get closer to your retirement lifestyle goals.

Risk Warning

A pension is a long term investment. The fund value may fluctuate and can go down. Your eventual income may depend on the size of the fund at retirement, future interest rates and tax legislation.